richmond property tax rate

2022 Tax Digest and Levy 5-Year History. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

About Your Tax Bill City Of Richmond Hill

Under the state Code reexaminations must occur at least once within a three-year timeframe.

. The real estate tax rate is 120 per 100 of the properties. Rockingham NC 28379 Business. Building Department.

We have done our best to provide links to information regarding the County and the many services it provides to its. Property Taxes Due 2021 property tax bills were due as of November 15 2021. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

Tax rate of 6 not raised in over thirty. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Taxpayers can either pay.

Welcome to the official Richmond County VA Local Government Website. Vagas Jackson Tax Administrator 1401 Fayetteville Rd. Richmond County collects on average 045 of a propertys.

For information and inquiries regarding amounts levied by other taxing authorities please contact. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. 295 with a minimum of 100.

A 10 yearly tax hike is the maximum raise allowed on the capped properties. Personal property tax bills have been mailed are available online and currently are due June 5 2022. The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300.

Ad Find The Richmond Property Tax Records You Need In Minutes. The City Assessor determines the FMV of over 70000 real property parcels each year. Richmond County collects on average 103 of a propertys.

These documents are provided in Adobe Acrobat PDF format for printing. Formulating real estate tax rates and conducting appraisals. Real Estate and Personal Property Taxes Online Payment.

Richmond City collects on average 105 of a propertys assessed. The current millage rate is 4132. The Mayor and Council of the City of Richmond Hill do hereby announce that.

Taxing units include Richmond county. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. The City Assessor determines the FMV of over 70000 real property parcels each year.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Along with collections property taxation involves two additional general steps.

City of Richmond Hill Property Tax. To learn more about the State of Virginia and City of Richmond tax rates please look below. Such As Deeds Liens Property Tax More.

The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. Electronic Check ACHEFT 095. These agencies provide their required tax rates and the City collects the taxes on their behalf.

Fort Bend County Property Values Up 35 Percent Since 2012 Community Impact

Cleveland Cash Flow 3 B2brealty Property Investors Rent

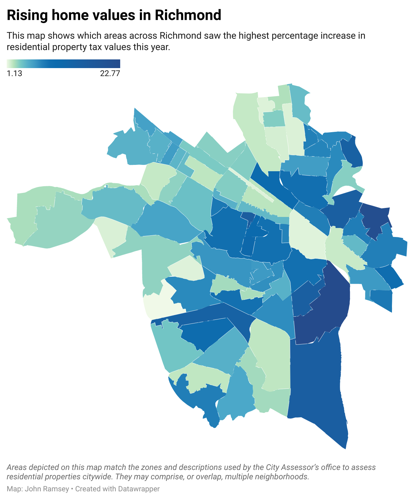

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

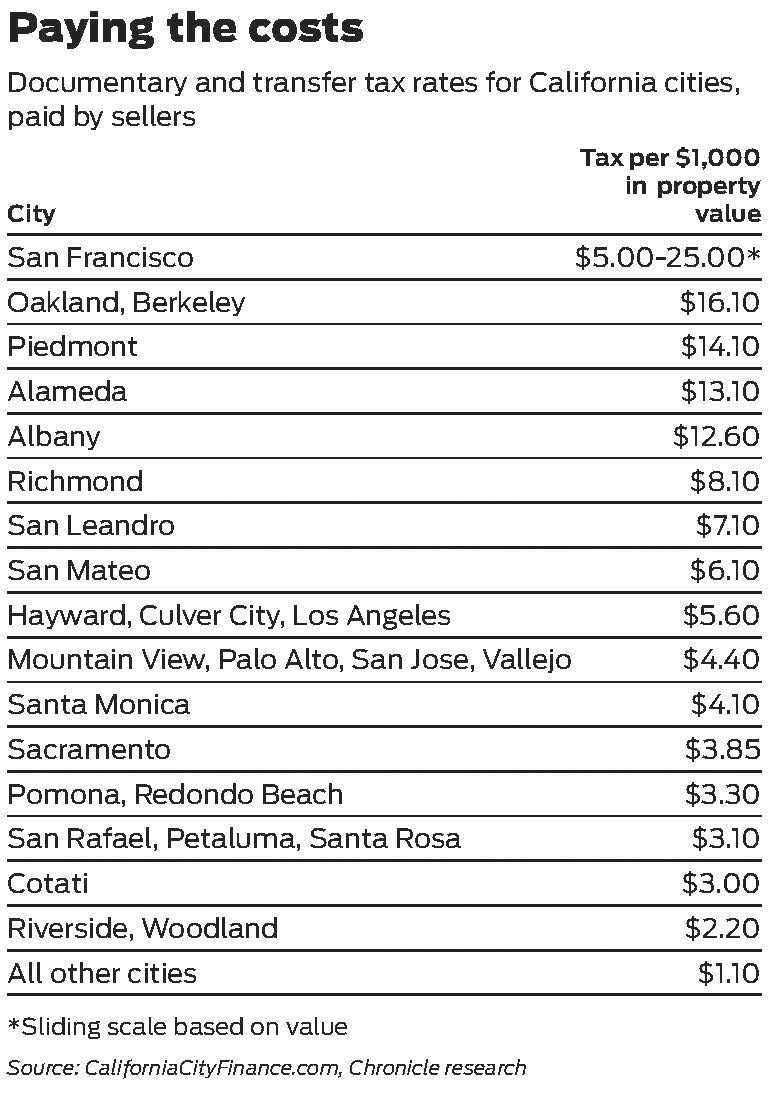

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

Real Estate Basic Facts Per Subdivisions Within Richmond Tx 77407

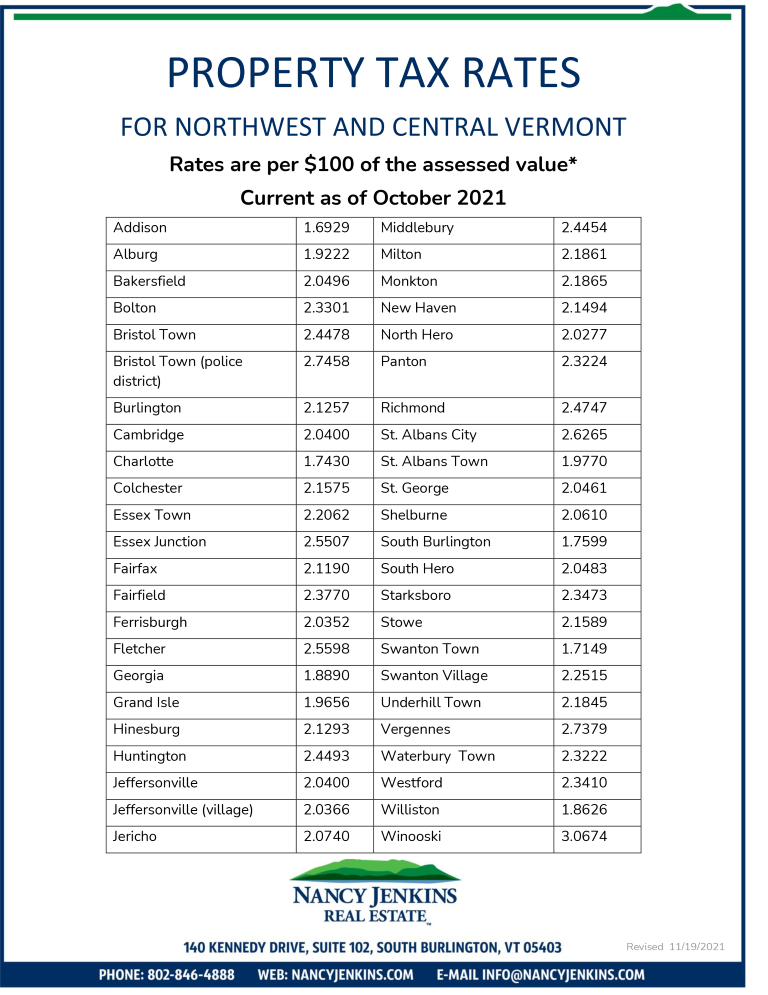

Vermont Property Tax Rates Nancy Jenkins Real Estate

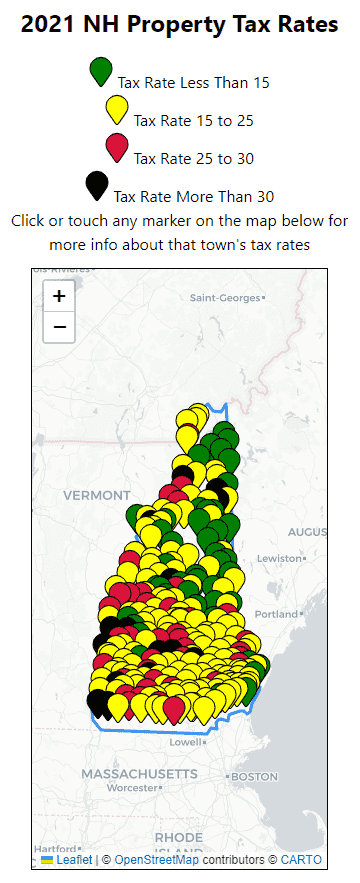

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Richmond And Henrico A Tale Of Two Revenue Streams Taber Andrew Bain

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

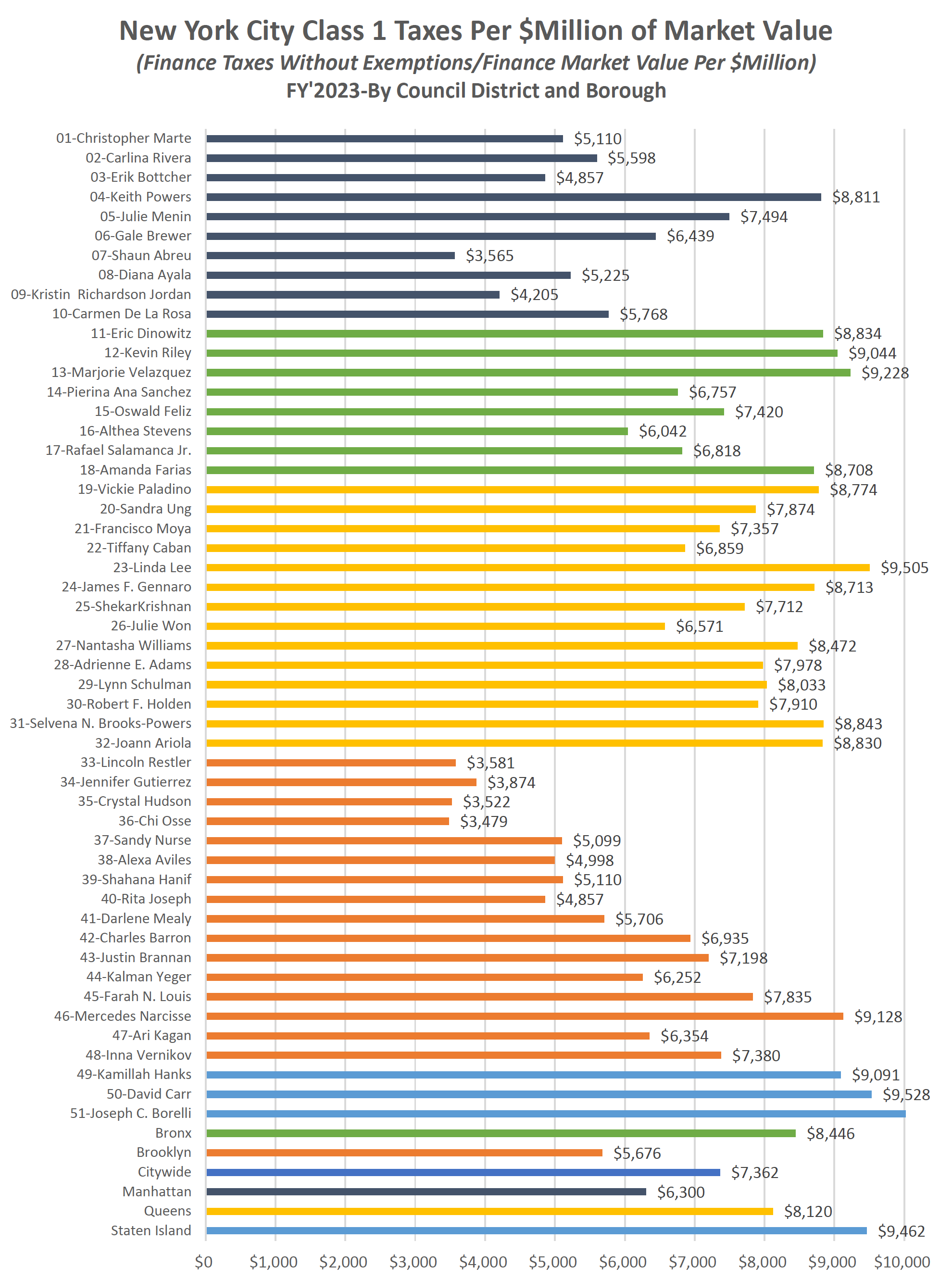

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

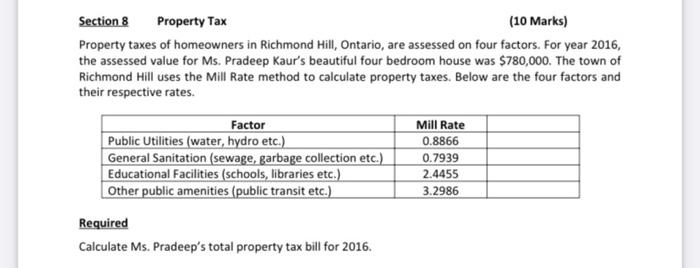

Solved Section 8 Property Tax 10 Marks Property Taxes Of Chegg Com

Real Estate Basic Facts Per Subdivisions Within Richmond Tx 77407

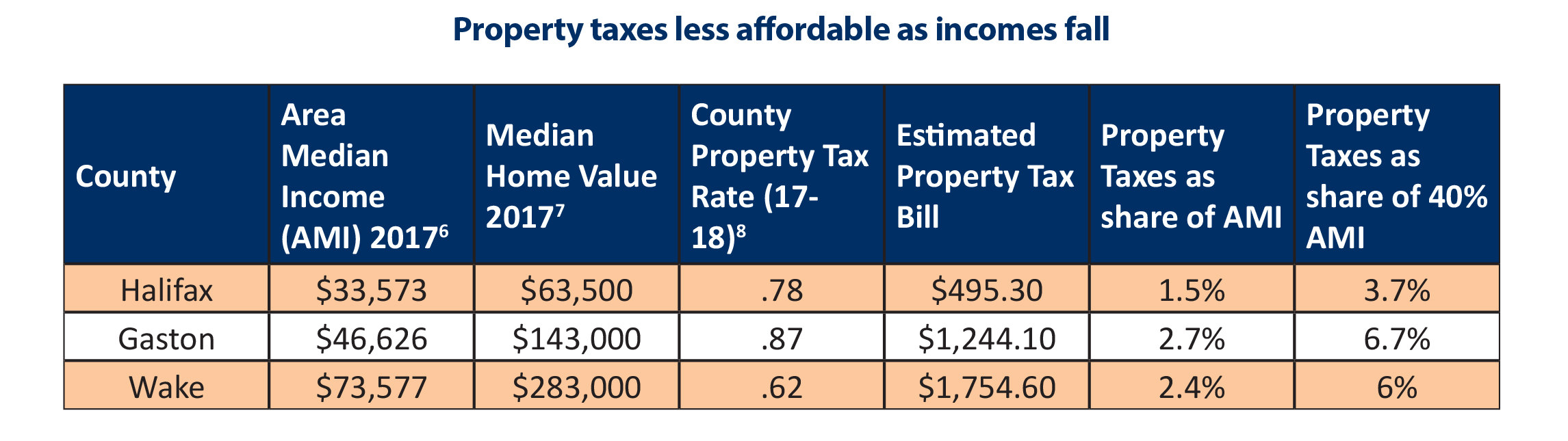

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

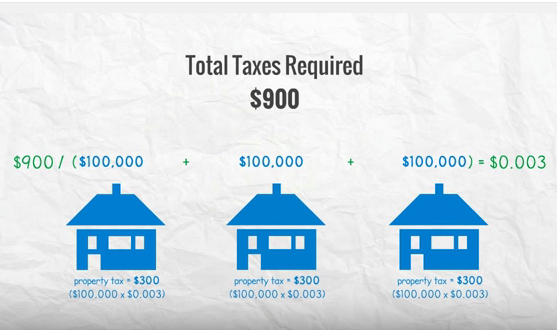

New Video Explains Property Tax Increases Richmond News

With A Steep Property Tax Hike Looming Richmond Officials Weigh Shifting Some Of The Burden To Second Home Owners Central Berkshires Berkshireeagle Com

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com